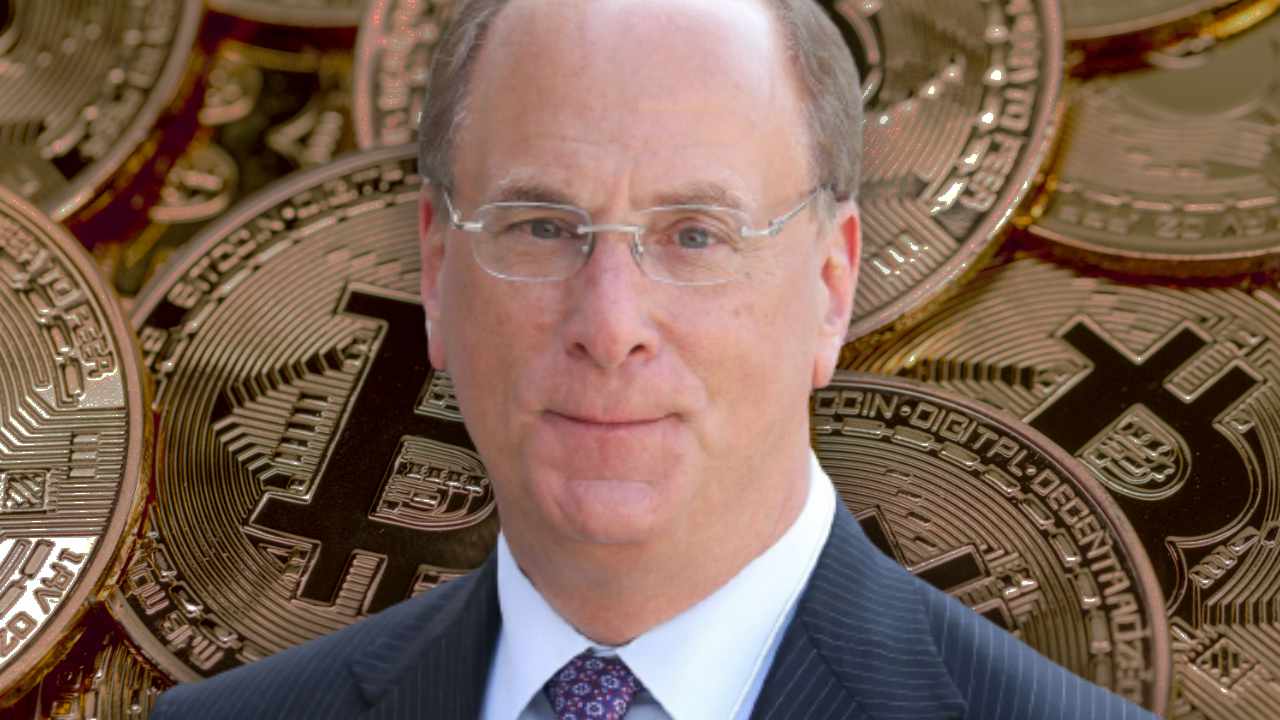

Is the world's largest asset manager inextricably linked to geopolitical tensions and ethical concerns? The actions and pronouncements of BlackRock's CEO, Larry Fink, suggest a compelling, yet controversial, narrative of financial power intertwined with political allegiances, particularly regarding the ongoing situation in Israel and Palestine.

The echo of "We did not find results for" followed by suggestions to "Check spelling or type a new query" highlights a consistent problem: the difficulty in obtaining a clear and unbiased picture. The digital landscape often struggles to offer a comprehensive account, which may be attributed to the complex interplay of corporate influence and media coverage. It compels a closer look at the individuals who shape global financial decisions and how these decisions resonate in geopolitical arenas. In the case of Larry Fink and BlackRock, it involves analyzing the implications of the firm's strategies and the public statements of its CEO, especially in the context of the Israeli-Palestinian conflict.

| Full Name: | Laurence Douglas Fink |

| Date of Birth: | November 2, 1952 |

| Nationality: | American |

| Education: | University of California, Los Angeles (UCLA), B.A. in Political Science |

| Career: |

|

| Professional Information: |

|

| Key Affiliations and Influence: |

|

| Political Stance: |

|

| Source: | BlackRock Official Website |

Born on November 2, 1952, Laurence "Larry" Fink has ascended the ranks of the financial world to become one of its most powerful figures. His role as CEO of BlackRock, the world's largest asset manager, affords him considerable influence over global markets and, by extension, geopolitical dynamics. The decisions made within BlackRocks headquarters have the potential to reshape economies, and the firm's investments often reflect, and even shape, prevailing political climates. It's a power that comes with scrutiny, as evidenced by the increasing attention focused on Fink's stance regarding Israel and Palestine.

The company's 3rd quarter investor call provides a window into this dynamic. During these calls, Finks comments on the current situation in Israel and Palestine take center stage, offering a glimpse into the firm's perspective on one of the world's most volatile regions. The fact that these comments were deemed "brief" suggests a strategic approach a careful navigation of sensitive ground. Yet, even a brief statement can send a powerful message, particularly when it comes from someone in Fink's position.

One element that has drawn attention is Fink's formal addressing of these complex matters, as perceived by some. This formality, however, shouldn't necessarily be interpreted as a sign of detachment; rather, it could point to a deliberate attempt to maintain a level of professional neutrality while operating within a framework of firmly held beliefs. It's a balancing act, aimed at securing financial stability and maintaining stakeholder confidence while also potentially aligning with other objectives.

The statement that "Larry Finks staunch support for Israel aligns BlackRock with Zionist objectives, particularly in its role in sustaining Israels economic dominance" raises critical questions about the connection between corporate power and geopolitical advocacy. While BlackRock operates as a global asset manager, its investments and political stances are not entirely divorced from each other. Every investment decision has an impact beyond the numbers. For instance, investments in Israeli companies and the broader Israeli economy can be seen as a tangible demonstration of support. The alignment of financial interests with political stances raises ethical questions for investors and observers, particularly when the support touches on issues of human rights and international law.

The suggestion that Fink is "cheering on a regional war" is a serious accusation that must be weighed carefully. It's crucial to differentiate between expressions of support for a nation and advocacy for conflict. However, the context of such statements is critical. Is the support unconditional, or does it include calls for peace and adherence to international standards? The public statements that Fink makes and the company's investment decisions together give rise to the complex and often controversial narratives surrounding corporate and personal influence on global geopolitics.

The absence of readily available information through standard search engines is revealing. The repetitive "We did not find results for" messages suggest an information landscape that may be shaped by various factors. This could include deliberate attempts to obscure information or a more general issue with how financial information is being categorized and made public.

The issue of "apartheid" has a clear bearing on this discussion, and the support from Fink raises questions. In the context of the Israeli-Palestinian conflict, the term "apartheid" is used by some to describe conditions and policies in the region. If BlackRocks CEO openly supports a regime accused of such practices, it leads to the complex ethical challenges that investors and stakeholders must navigate. This creates a space where ethical considerations come into conflict with financial interests.

The case of BlackRock, under Larry Fink's leadership, serves as a microcosm of the bigger forces that shape the world. It serves as a cautionary tale that illustrates the responsibility associated with global influence. The actions and statements of key leaders within major financial institutions have a significant effect on how we understand our place in the world, and their approach affects the decisions that shape the future. Those choices must be made with a commitment to transparency and ethical decision-making.

The fact that Fink addressed Israel on the company's earnings calls provides further evidence of the intersection of finance and political alignment. During these calls, decisions regarding the companys investments can also be connected to the political positions held by the CEO and the firm. Investors and analysts pay attention to the language used in these communications, interpreting it as indicators of the company's wider strategy and any potential risks it may be taking on.

The situation necessitates a cautious assessment of the available information. It involves looking beyond the surface, critically assessing sources, and understanding the possible motivations behind statements and actions. The goal is to promote a deeper understanding of the dynamics shaping today's world and the complexities of financial power.

The repeated difficulty in finding information when searching on the internet is a problem that goes beyond specific search terms. It could reflect broader issues regarding control over information distribution and the potential influence of powerful entities. This forces individuals to rely on different sources of information, and forces them to think more carefully about the origin and motivations of those sources.

The discussion about BlackRock and its CEO, Larry Fink, highlights the complex relationship between finance, politics, and ethics in today's world. It compels us to examine the power of large financial institutions and the role that leaders like Fink play in global events. It's important that this discussion is thorough, transparent, and open to different perspectives.

BlackRock's role in sustaining Israels economic dominance raises the crucial question of the effects of corporate investment on geopolitical stability. The involvement of large financial firms can have a variety of effects on the dynamics of conflict and peace, either encouraging or suppressing it. This is a crucial factor, as it touches on important questions of ethical investment and responsible corporate behavior.

Larry Fink's legacy will likely be tied to the growth and impact of BlackRock, including the way in which the firm dealt with political and ethical challenges. His leadership style and choices, along with the company's actions, have the potential to impact the future of finance and the world.

In conclusion, the available information indicates that Larry Fink's leadership of BlackRock reflects the intricate link between global finance and political dynamics. The challenges raised by his support of Israel, the firms strategic investments, and the difficulty in obtaining comprehensive and unbiased information require careful consideration. The impact of corporate power and the need for transparency and ethical behavior will shape the ongoing conversation.